pa local tax filing deadline 2021

Opens In A New Window. The personal income tax filing deadline was originally set for today April 15 2021 but the department in mid-March announced an.

York Adams Tax Bureau Pennsylvania Municipal Taxes

Contact us to quickly and efficiently resolve your tax needs.

. Clearance Form for Tax Credits. We are Pennsylvanias most trusted tax administrator. Keystone Collections Group collects current and delinquent tax revenue and fees for Pennsylvania school districts boroughs cities municipalities and townships.

11 rows BLAIR TAX COLLECTION DISTRICT. The local earned income tax filing deadline. The Internal Revenue Service also.

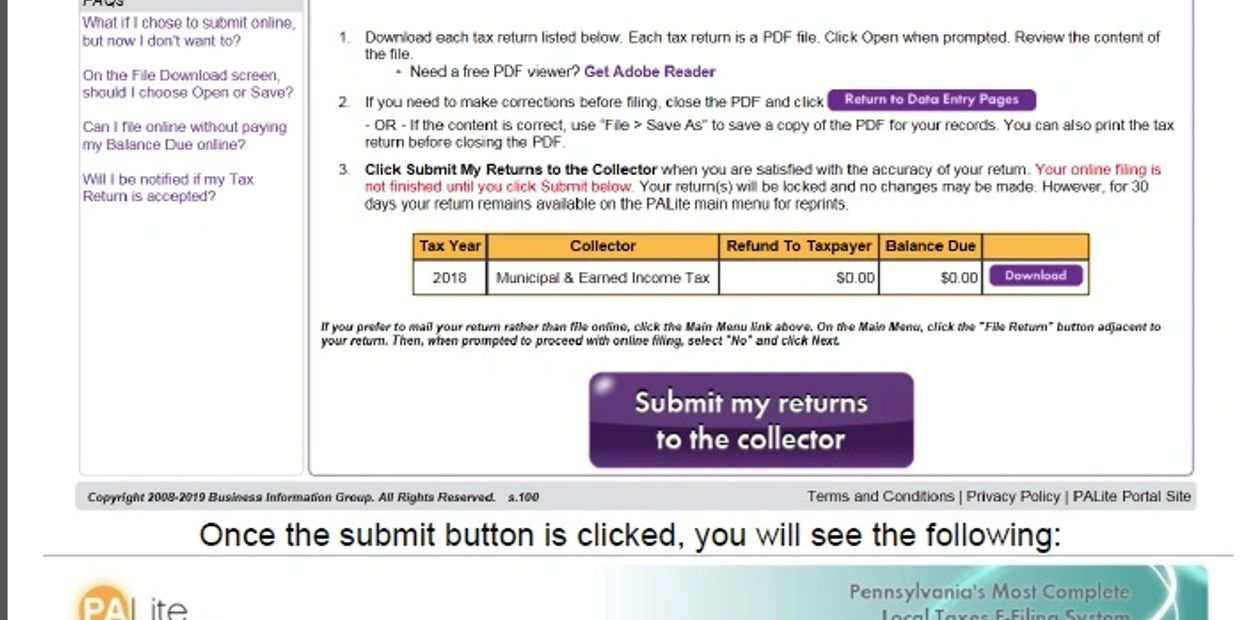

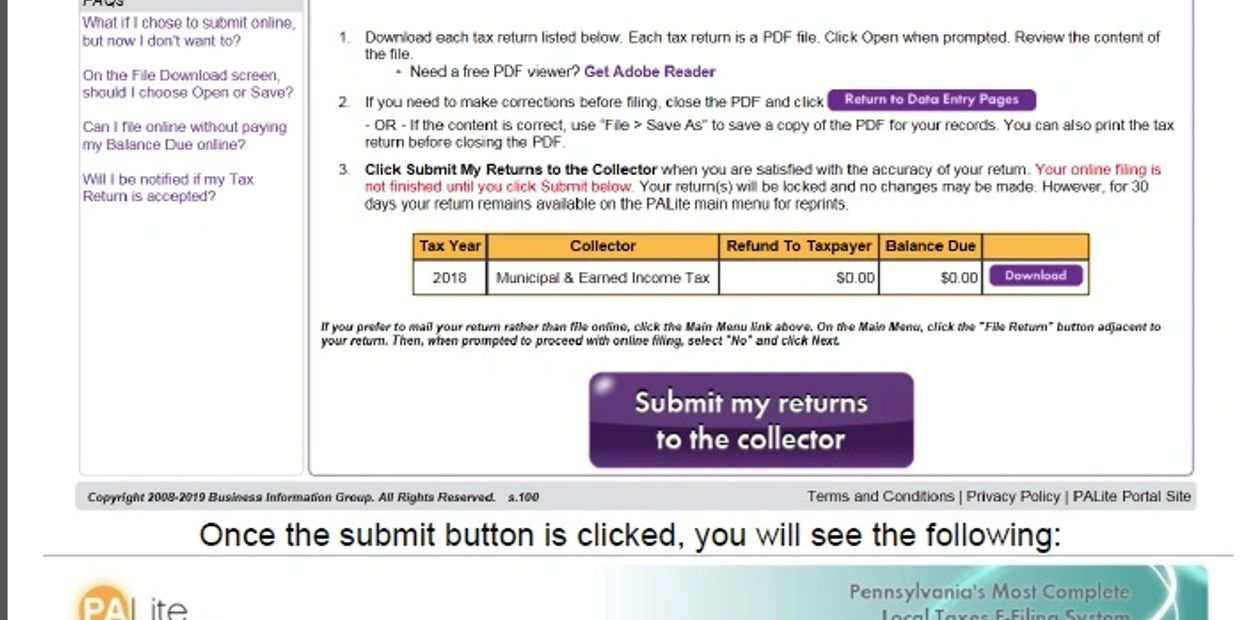

Pennsylvania residents with earned income or net profits must file a local earned income tax return online or by mail by April 18 2022. The PA Department of Revenue and the IRS announced that the income tax filing deadline for the final annual return 2020 is extended to May 17 2021. Taxpayers should write 2021 Estimated Tax Payment and the last four digits of the primary.

Complete the W2-R Annual Reconciliation Earned Income Tax Withheld From Wages Form. For more information and to apply for the Local Resource Manufacturing Tax Credit contact the Department of Revenues Office of Economic Development at 717-772-3896 or ra-rvtaxcreditspagov. Tom Wolf has signed into law a bill that extends the personal income tax filing deadline for.

On or before the last day of February following the close of the calendar year employers must complete and submit the W2-R Annual Reconciliation Earned Income Tax Withheld From Wages form to the appropriate local tax collectors. Sales Use and Hotel Occupancy Tax Monthly. Harrisburg PA The Department of Revenue is reminding the public that the deadline for filing 2020 Pennsylvania personal income tax returns and making final 2020 income tax payments is May 17 2021.

The Internal Revenue Service pushed back the filing deadline for taxes to May 17th. Pennsylvania is delaying the deadline to file state income taxesThe Pennsylvania Department of Revenue announced Thursday that the deadline for. All residents of Adams County and all residents of York County except West Shore School District file their annual earned income tax returns with YATB.

Every resident part-year resident or nonresident individual must file a Pennsylvania Income Tax Return PA-40 when he or she realizes income generating 1 or more in tax even if no tax is due eg when an employee receives compensation where tax is withheldRefer to the below section on TAXATION for. Sales Use and Hotel Occupancy Tax Semi-Annual. The Bureau also collects Local Services Tax.

Wolf today signed House Bill 766 into law aligning the annual state corporate tax deadline with the federal tax deadline of May 17 2021 and giving the Pennsylvania departments of Revenue and Community and Economic Development the ability to deal with state taxation while the COVID-19 disaster declaration is in effect. Posted Thu Mar 18 2021 at 219 pm ET. The department will be able to process 2021 personal income tax estimated payments made in 2021 if taxpayers complete and mail a PA-40ES I Declaration of Estimated Tax coupon to the department along with their check for the estimated tax amount.

While the PA Department of Revenue and the IRS announced. Description Start Date End Date Due Date. Shutterstock PITTSBURGH PA The city of Pittsburgh is extending its personal income tax filing deadline until May 17 in line.

Harrisburg PA The Department of Revenue today announced the deadline for taxpayers to file their 2020 Pennsylvania personal income tax returns and make final 2020 income tax payments is extended to May 17 2021This means taxpayers will have an additional month to file from the original deadline of April 15. However Michael Herzog JD the tax expert. We specialize in all Pennsylvania Act 32 and Act 50 tax administration services.

The states tax-filing deadline is tied by law to the federal deadline the department said. 2021 Personal Income Tax Forms. Eric Heyl Patch Staff.

2021 CAMPAIGN FINANCE REPORTING DATES Not applicable to candidates running for Federal offices TYPE REPORT COMPLETE AS OF FILING DEADLINE 2020 Annual Report December 31 2020 February 1 2021 6th Tuesday Pre-Primary March 29 2021 April 6 2021 2nd Friday Pre-Primary May 3 2021 May 7 2021 30-Day Post-Primary June 7 2021 June 17 2021. We are the trusted partner for 32 TCDs and provide services to help Individuals Employers Payroll Companies Tax Preparers and Governments. Replies 47 Shutterstock HARRISBURG PA Gov.

E-Tides Tax Due Dates. Keystone Collections said today The Local Earned Income Tax filing deadline has NOT been extended beyond the April 15 2021 due date. The York Adams Tax Bureau collects and distributes earned income tax for 124 municipalities and school districts in York and Adams Counties.

Blair County Tax Collection. Electronic Revenue Clearance Form Instructions for Tax Credit and Economic Development Programs. Brief Overview and Filing Requirements Who Must File.

Timely FilingPayment Schedule All Tax Systems. Delinquent Per Capita and Occupation. PA now confirming its matching IRS extension for filing 2020 tax returns to May 17.

Description Start Date End Date Due Date.

State W 4 Form Detailed Withholding Forms By State Chart

Municipal And School Earned Income Tax Office

Pennsylvania Property Tax H R Block

How Do State And Local Individual Income Taxes Work Tax Policy Center

California Tax Forms H R Block

Tax Filing Season 2022 What To Do Before January 24 Marca

When Are Taxes Due In 2022 Here Are All The Major Deadlines Money

Prepare And Efile Your 2021 2022 Pennsylvania Tax Return

Guide To Local Wage Tax Withholding For Pennsylvania Employers

Income Tax Return Filing Deadline What Time Are Taxes Due In 2022 Marca

Pennsylvania State Tax Refund Pa State Tax Brackets Taxact Blog

Municipal And School Earned Income Tax Office

/cloudfront-us-east-1.images.arcpublishing.com/pmn/5HGIEYMH75DNDA6GRD4TJ5RI6A.jpg)

Live In Pa Or N J Irs Extends Tax Filing Deadline To Feb 15 For Victims Of Hurricane Ida

.png)